Here are the levels I have plotted on Apple’s weekly chart. Apple struggled to hold $220, but the tariffs on China will directly affect it. Next stop $196. $182.75 -> 166.75.

A Personal Finance Blog for Building Wealth and Securing Your Financial Future

Here are the levels I have plotted on Apple’s weekly chart. Apple struggled to hold $220, but the tariffs on China will directly affect it. Next stop $196. $182.75 -> 166.75.

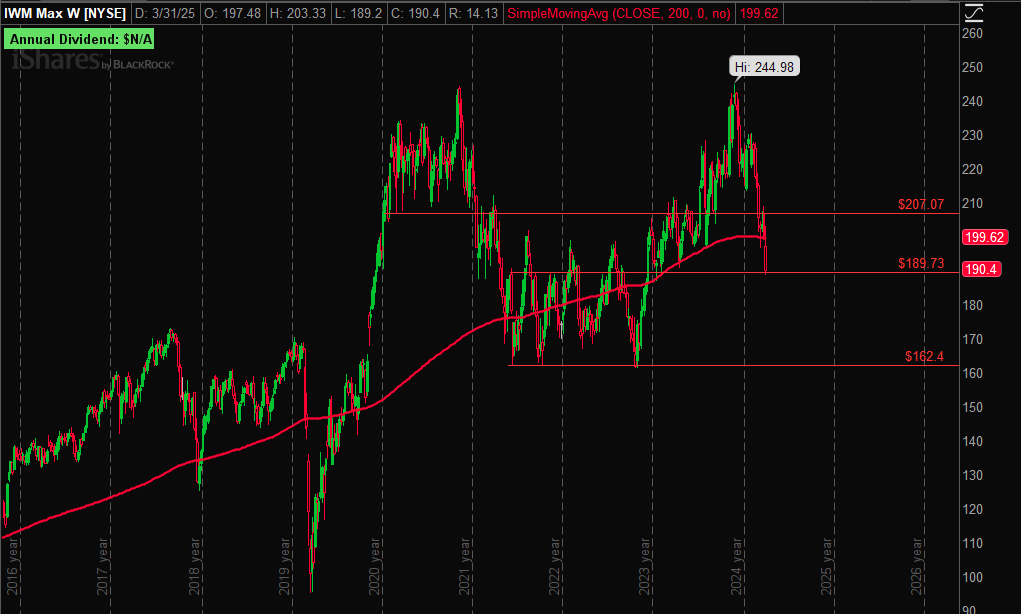

Here are the levels I have plotted on Russell 2000 ETF’s weekly chart. If it can’t get back above $207 or hold $190, it could drop all the way down to $162.50.

Here are the levels I have plotted on Microsoft’s weekly chart. $367.50 -> $345 -> $310.

Here are the levels I have plotted on Rocket Lab’s weekly chart. $16.50 -> $14 -> $10..

Here are the levels I have plotted on Nvidia’s weekly chart. It really needs to hold 90, or it could drop down to $75.50.

Question: What are some stock tickers that deal with copper?

Remember that the performance of these stocks can be influenced by numerous factors, including global copper demand, commodity prices, geopolitical events, and company-specific factors. It’s crucial to conduct detailed research and consider your investment goals, risk tolerance, and market conditions before making any investment decisions.

A leap option, also known as a long-term equity anticipation security, is an options contract with an expiration date that is farther in the future than standard options. Typically, leap options have expiration dates ranging from several months to a few years. These options provide investors with the right, but not the obligation, to buy or sell a specific underlying asset, such as stocks, at a predetermined price (strike price) within a specified time frame.

Leap options are similar to standard options but have a longer time frame, which gives investors more time for their predictions to materialize. They can be used for various trading and investment strategies, including hedging, speculation, and income generation.

It’s important to note that options trading involves risks, and leap options are no exception. They are subject to factors such as changes in the underlying asset’s price, time decay, implied volatility, and market conditions. Before engaging in options trading, it’s crucial to have a solid understanding of the concepts and risks involved or seek advice from a qualified financial professional.

Day trading is a strategy where an investor buys and sells securities on the same trading day. This can be a high-risk, high-reward strategy, and it requires discipline, research, and a solid understanding of the market. Here are some popular day trading strategies:

It’s important to note that day trading is a high-risk strategy and it’s not suitable for everyone. It requires discipline, research, and a solid understanding of the market. Before engaging in day trading, it’s important to educate yourself, understand the risks and have a well-crafted plan.

Trading psychology refers to the mental and emotional aspects of trading. It includes the beliefs, attitudes, and behaviors that can affect a trader’s decision-making process. Understanding and managing trading psychology is crucial for long-term success in the markets. Here are some trading psychology techniques that traders can use to improve their performance: