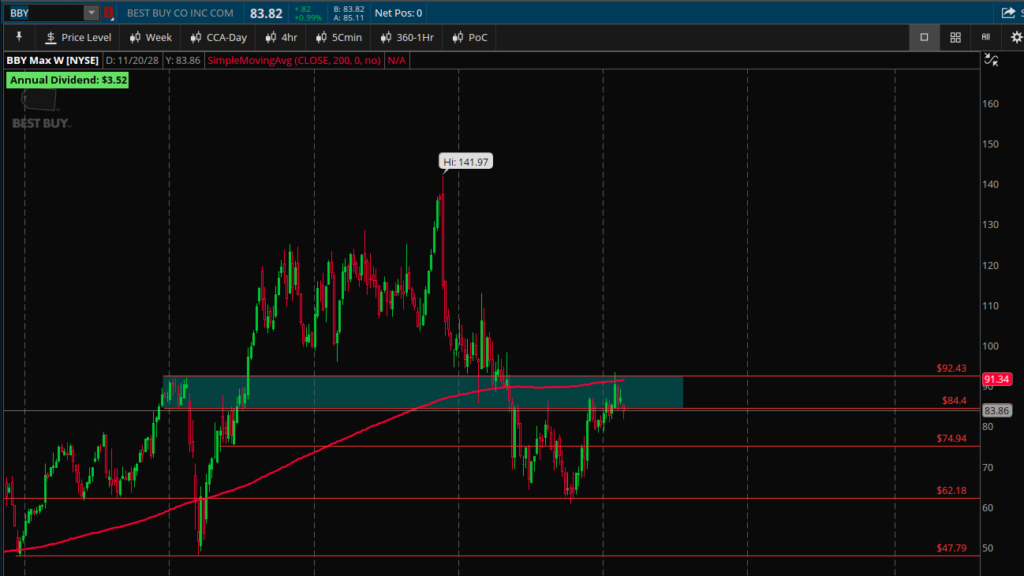

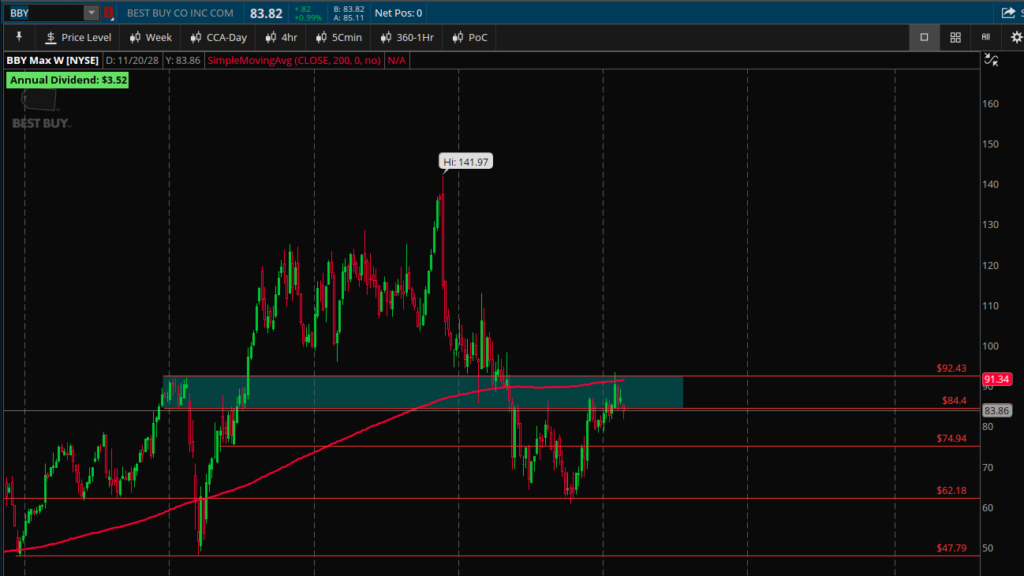

Bullish – above $84.50 -> $92.50

Bearish – below $84.50 -> $75.

A Personal Finance Blog for Building Wealth and Securing Your Financial Future

Bullish – above $84.50 -> $92.50

Bearish – below $84.50 -> $75.

Costco has been ranging between $450 and $560. Good earnings may push it to test the downward trendline. If it breaks the trendline, I will be watching to see if it tests $540. Bad earnings, I’ll be looking for a test of the bottom of the channel around $450.

This is the weekly chart. Pay attention to a break of $210 to the upside. If it does, look for a run to $220 – > $230. Rejection of $210 -> $200.

A covered call is a strategy used in options trading where an investor sells a call option on a stock or other underlying asset they already own. By selling the call option, the investor earns a premium, which is the price paid by the buyer of the call option for the right to purchase the underlying asset at a specific price (called the strike price) for a set period of time.

The term “covered” refers to the fact that the investor already owns the underlying asset that the call option is based on. This means that if the buyer of the call option exercises their right to purchase the underlying asset at the strike price, the investor can simply sell the asset to the buyer and fulfill the option contract. The investor is said to be “covered” because they have the underlying asset to sell if needed.

The goal of the covered call strategy is to earn income from the premiums received from selling the call option, while potentially also benefiting from any increase in the price of the underlying asset. However, the investor’s potential profit is limited by the strike price of the option, since they would have to sell the underlying asset to the buyer of the call option at that price if the option is exercised.

ETF stands for “Exchange Traded Fund.” It is a type of investment fund that is traded on stock exchanges, just like stocks. ETFs are designed to track the performance of a particular index, commodity, or basket of assets.

ETFs are similar to mutual funds in that they pool money from multiple investors to purchase a diversified portfolio of assets. However, ETFs are traded on exchanges like stocks, which means they can be bought and sold throughout the trading day at market-determined prices. This makes ETFs more flexible than mutual funds, which are typically only priced once per day.

There are many different types of ETFs available, including those that track stock indices, bond indices, commodity prices, and even specific sectors or industries. Some ETFs also use complex strategies such as leverage or shorting to amplify or inverse the returns of the underlying assets.

Day trading is a strategy where an investor buys and sells securities on the same trading day. This can be a high-risk, high-reward strategy, and it requires discipline, research, and a solid understanding of the market. Here are some popular day trading strategies:

It’s important to note that day trading is a high-risk strategy and it’s not suitable for everyone. It requires discipline, research, and a solid understanding of the market. Before engaging in day trading, it’s important to educate yourself, understand the risks and have a well-crafted plan.